Why is it necessary to review your credit score regularly?

Maintaining a financial health is the same as maintaining the physical fitness. To remain physically healthy, we need to maintain a discipline in our life. Similarly, to have a good credit score, one needs to keep track of all the financial parameters.

Reviewing your credit score frequently keeps you updated about any changes in your financial progress. You can get to know easily when, and, for what reasons, the score goes down. Similarly, if the score increases, you can easily be able to track the financial activity that helps in increasing the credit score.

Benefits of doing credit score checks regularly

1. Track the after-effects any financial activity

Frequently checking the credit score helps in monitoring the financial actions. It will help you in analyzing that your action is affecting your credit score positively or negatively. If you understand the reason for the credit score lowering down, and work in the same, timely, to get the better offers on personal loans, home loans, etc.

2. CIBIL Score check ensures accuracy of information

Sometimes due to wrong information or result of an error also, the credit score reduces. If you are doing frequently credit score checks, you can report it immediately to the respective credit bureau and request them for investigation.

3. Get to know about pre-approved loan offers:

Online many lending platforms are available that are offering the facility of free CIBIL score check. On these platforms, you also get to know about the customized loan and credit card offers as per the eligibility. If your credit score is 750, or above, you get the negotiating power. You can get the loan and credit card approved at your terms and conditions.

4. Helps in maintaining a healthy credit profile

Frequently going for a CIBIL Score check helps in maintaining a credit score and report. A credit score is a numerical representation of your financial behavior. A better credit score validates your credit behavior in front of the lender. On the other hand, a low credit score is an indication that you need to work harder to boost up your credit score before applying for any loan or card.

Ways of improving the Credit Score:

• Pay your bills on time

• Leave no dues of old loan or credit card payments

• Keep your credit utilization ratio max to 30%

• Set reminders to avoid missing of EMIs for loans

• Do not apply for multiple credit cards or loans

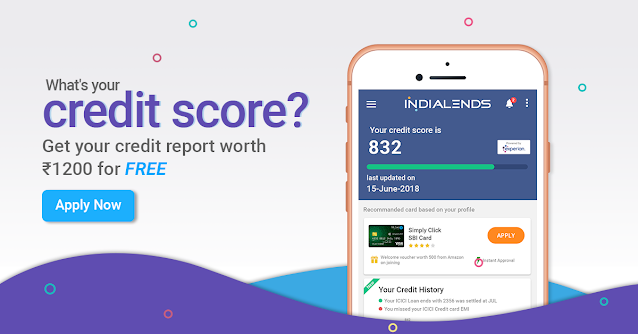

Online many lenders are offering CIBIL Score free check, IndiaLends is one of them who are offering these value-added services along with the best unsecured loan and credit card offers based on your credit profile.

Comments

Post a Comment