Everything you need to know about Credit score and Credit report

A credit score is a three-digit number that is to be obtained by the information available on your credit report. It is done through an algorithm to know about your creditworthiness. Lenders check your credit score to decide how good you in making loan repayment. There are many credit scorings models available among the most popular ones is the FICO® Score*. Higher will be your credit score better would be the chance of having a personal loan and a credit card approval.

Even credit score is playing a significant role in credit management, still, people are not taking much care of their credit scores.

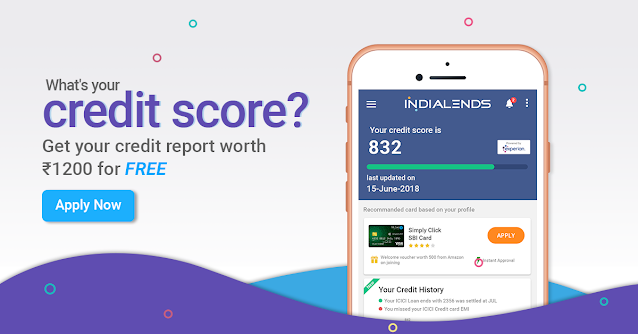

Process of a free credit score check is as follows:

Visit a website: Look out for the website which is offering a free credit score check. As online many websites offer free CIBIL scores intending to make you understand how well you are doing credit-wise. You get a CIBIL score online via any of the credit bureaus also.

Check with your lender or credit card issuer: There are many car loan and credit card companies which were offering free check of CIBIL scores online for the convenience of the loan applicant. You can make an account online into their websites and get the required information.

Consulting a non-profit credit counselor: Consulting them, will help you in pulling your scores for free and go over the details with you. To find one, check with the National Foundation for Credit counseling.

What factors need to keep in mind when you are checking your ‘Free Credit Report’

• Payment history: Credit Report shows how frequently and sincerely you are making a payment of your bills. If the report reflects missed or late payment status, in that case, it will hurt your credit score.

• Credit Utilization: The calculation of the same is done by dividing how much credit you are using by the total amount of credit available to you. Lesser will be your credit utilization, better will be your credit scores. Credit utilization should be 30% of your total income.

• Length of credit history: It shows how long you are making use of the credit, which includes your newest and oldest accounts as well as an average of all the open accounts. It accounts for 15% of your score. So long, you are making use of the credit, better will be your credit score.

• New credit: It shows how many recent hard inquiries you have on your credit report. Too many new accounts and inquiries could indicate greater credit risk.

• Credit mix: So, if you are having different kinds of credit, like credit cards and Installment loans, it will result in having a good credit score.

So, get a free credit report as there are 4 credit bureaus, so in a year, you can have access to four credit reports. It will help you in improving your financial credibility along with showing your financial position via your credit score.

Comments

Post a Comment