How to check your credit score online at IndiaLends

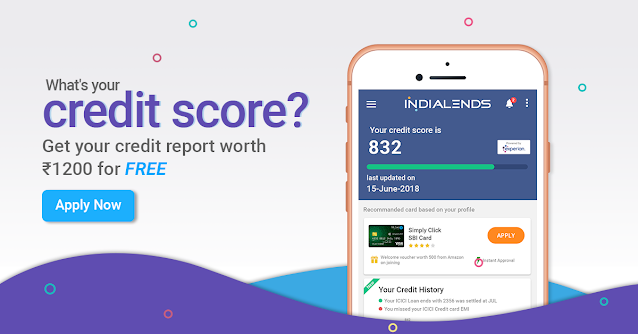

With the advent of Fintech companies like IndiaLends, you can easily check your credit score and download credit reports for free in just a few clicks. The whole process is easy and less time-consuming. To check your free credit score online at IndiaLends, you need to follow these steps.

Step 1: Visit Indialends.com and click on the ‘Credit Report’ button

Step 2: You will be redirected to the page (https://indialends.com/free-credit-report) where you can check your score and download credit report

Step 3: Now, click on 'Check Your Free Score' tab

Step4: Now, you need to fill the credit report application form that mentions details like employment type, monthly in-hand salary, enter your first and last name as per PAN, email address, gender, date of birth, current residence Pin code, the city you live in, mobile number and PAN number

Step 5: After entering all these details, you will be shown your credit report

What are the benefits of checking the credit report?

These are the several benefits of checking your free credit report:

1. Know your credit standing: Checking your free credit report online will help you to know where you stand. Whether it's good or bad, it's better to know your credit score and know where you stand in terms of your credit track record as viewed by banks. If you have a low score, you can take steps to improve it. If you have a good credit score, you can focus on maintaining it.

2. Get errors in your credit reports rectified: Checking your credit score can help you to check if the information recorded in your credit report is accurate or not. In case there is an error, get in touch with the credit bureaus to get it rectified immediately.

3. Land up with better offers: Knowing your credit score beforehand also helps borrowers to land up with the best offers and give them the ability to negotiate for better interest rates with the lender. Therefore, it is important to check your free credit report online beforehand while applying for loans to get a low rate of interest.

4. Avail pre-approved offers: Fintech companies not only allows free credit report check but also have pre-approved offers for various loans for different ranges of credit scores because of their tie-ups with various lenders. You can also compare the offers available from different financial institutions and pick the best one that meets your requirements.

Fintech companies have made the checking of credit score a hassle-free and less-time consuming task. IndiaLends offers free credit score and a detailed credit analysis report which helps you make informed decisions and discover credit products like loans and credit cards that are best suited for you. All you need to do is fill in your details and you are ready to go.

Comments

Post a Comment